Overheated Real Estate Market Begins to Cool

The pandemic created a frenzied real estate market in much of the United States that has yet to let up, with demand for housing still outpacing …

The pandemic created a frenzied real estate market in much of the United States that has yet to let up, with demand for housing still outpacing the number of homes coming on the market, giving sellers a heavy upper hand in most of the country. But economists say the market cooled off a bit in July — perhaps a sign that the wild price appreciations of the past year may have scared off some buyers who prefer to wait until things calm down, to stay put or to continue renting.

Nationally, U.S. median home prices held steady from June to July at $385,000. That’s up 10.3 percent from last year at this time, according to the latest data from Realtor.com. It’s slower growth than the 12.7 percent increase in June 2021, and it marks the third month in a row in which the year-over-year gains have slowed.

“There’s a lot of buyer sticker shock,” said John Burns, the chief executive of John Burns Real Estate Consulting, based in Irvine, Calif. “People who are a little more investment oriented or who maybe already own a home have pulled back.” Mr. Burns said prices could see a correction in the coming months in many markets — but not a dramatic one. “If prices have gone up 20 percent and then dip 2 percent, it’s not the end of the world,” he said.

“It is just moving from super hot to normal hot,” said Lawrence Yun, the chief economist for the National Association of Realtors, which has not yet released its July data. “It is still a seller’s market.”

It may also signal the return to a normal seasonal dip with many schools back in-person and delayed summer vacations finally underway. In 2020, the market came to a near standstill after Covid lockdowns hit in early spring — typically the busiest home buying season of the year. But it roared back to life during the summer, with people upgrading to larger homes or leaving cities for suburbia, even as inventory fell steeply across the country. Home buyers continued to flood the market with demand through the fall and winter, peaking this past spring.

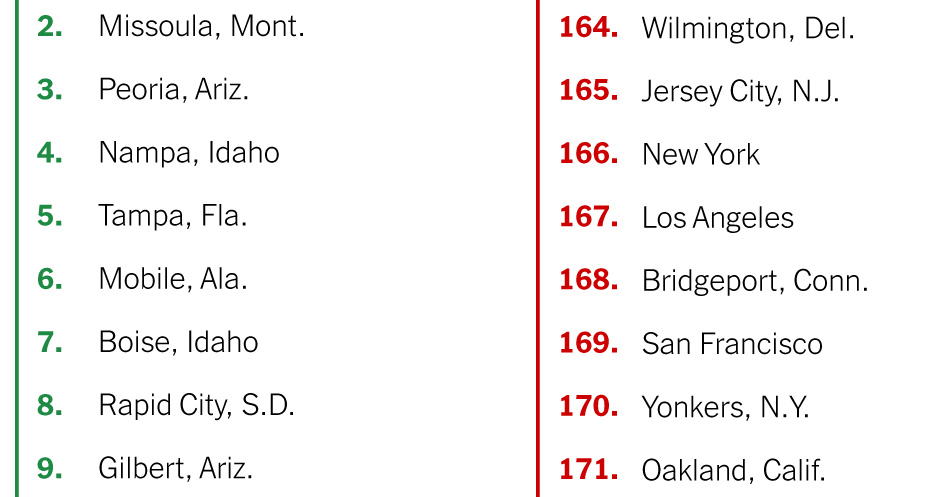

Economists say the Delta variant’s impact on housing will likely be to accelerate the hybrid and work-from-home trend that is driving buyers with the means to do so to upgrade to larger houses — a trend that often takes people further from the urban core or to less expensive cities. And interest rates remain low, another factor in surging housing demand.

Danielle Hale, Realtor.com’s chief economist, said last month’s slower price growth was skewed because a larger share of smaller, entry-level homes hit the market compared to a year prior, bringing the median price growth down overall. But a typical 2,000-square-foot home still saw brisk price appreciation, up 18.7 percent from July 2020.

“For buyers looking for smaller, entry-level type homes, that’s good news,” Ms. Hale said. “I still wouldn’t say those homes are plentiful, but there’s more of them for sale now than there was a year ago.”

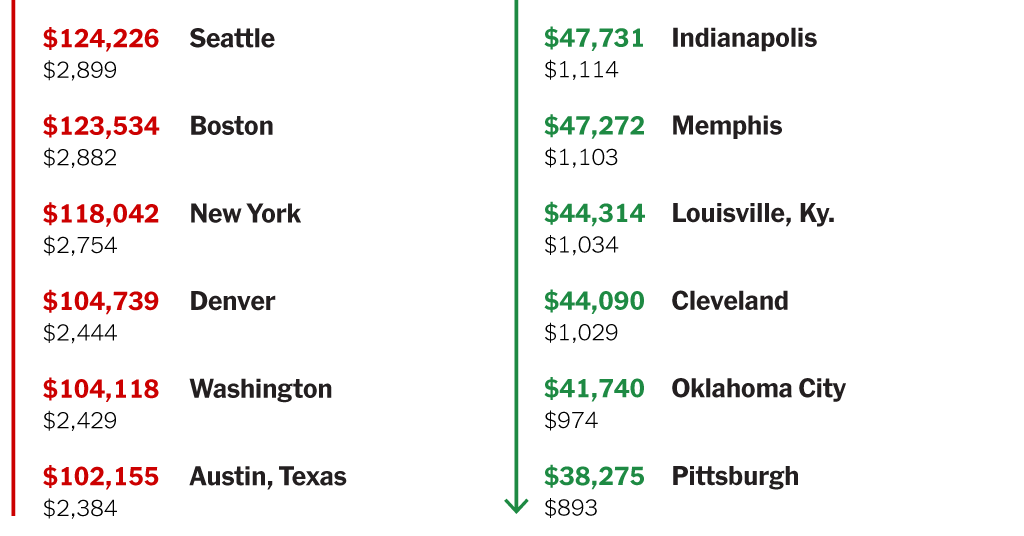

The most dramatic price appreciation happened in Western states and in suburban and exurban areas where buyers are looking for larger, single-family houses and relatively affordable prices. Austin, Texas, saw the biggest jump, with prices up 40 percent from last year, said Mr. Burns. Prices were softest in the Midwest and the Northeast, according to Realtor.com.

Patton Drewett, a real estate agent with Compass in Austin, said homes under $1 million were the most in demand in his area, with the price surge partly driven by buyers moving to Austin after cashing out of pricier cities like San Francisco, Los Angeles and New York. “I’m having to put five to ten offers out on homes to get something into contract,” he said. One client recently put a $975,000 offer on a home listed for $800,000. They didn’t get the house. “It certainly feels like the Wild West in terms of what people are willing to pay.”

Mr. Drewett said he saw things cool off in July, with homes getting between two and ten offers — down from the 30 to 40 offers a home might have gotten in the spring. But in the last two weeks or so buyers have returned from vacations and are once again shopping for homes, he added.

Nationally, the average home took 38 days to sell in July, up slightly from 37 days a year ago, according to Realtor.com, another sign of things slowing down a bit. The number of homes listed for sale was up 6.5 percent in July versus last year, which Ms. Hale said is a leading indicator of where the market is headed. “It’s still going to be a competitive market,” said Ms. Hale. “But we’re going to start to see more balance.”

For weekly email updates on residential real estate news, sign up here. Follow us on Twitter: @nytrealestate.