Can You Still Afford a Mortgage?

With the quick escalation of home prices during the pandemic, it’s become increasingly difficult to qualify for a typical mortgage. This week we …

With the quick escalation of home prices during the pandemic, it’s become increasingly difficult to qualify for a typical mortgage. This week we return to the quarterly report from HSH.com, which breaks down the annual income required to qualify for a mortgage in the country’s 50 largest metropolitan areas.

Using 2021 second-quarter sale price data for single-family homes from the National Association of Realtors (NAR), and factoring in the industry standard 28 percent debt-to-income ratio to qualify prospective borrowers, the report determined the income required for a mortgage in each area. (A 20 percent down payment and a fixed-rate, 30-year loan at current rates were assumed, and local property taxes and homeowner’s insurance costs were included.)

NAR’s national median sale price in Q2 2021 was $357,900, roughly 22 percent higher than a year earlier. At that price, an annual income of $68,032 would be required to qualify for a mortgage, with a monthly payment of $1,587.

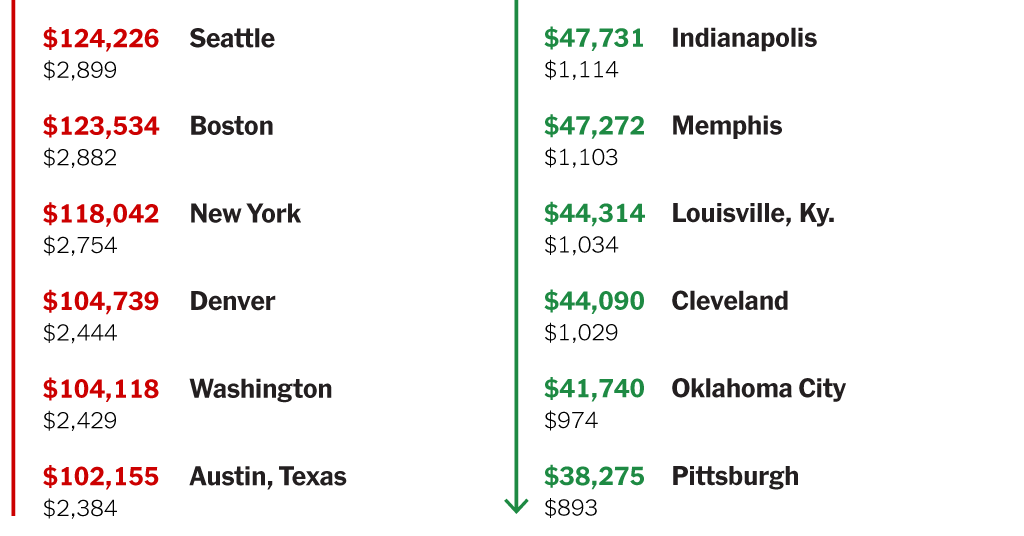

Most affordable was Pittsburgh, where the median sale price of $175,000 required an income of $38,275 and monthly payments of $893. San Jose, Calif., with a median sale price of $1.699 million, required the highest income, $286,703, with a monthly payment of $6,690.

This week’s chart shows what you’d need to earn in the 10 most affordable and 10 least affordable metros, and what your monthly loan payment would be in each.

For weekly email updates on residential real estate news, sign up here. Follow us on Twitter: @nytrealestate.